[ad_1]

The story throughout the pandemic all tied back to material

shortages in numerous industries including the commercial vehicle

market. Those shortages led to higher costs in inputs, labor, and

logistics because inventory was exhausted. New vehicle production

shortages had a domino effect on current vehicles in operation.

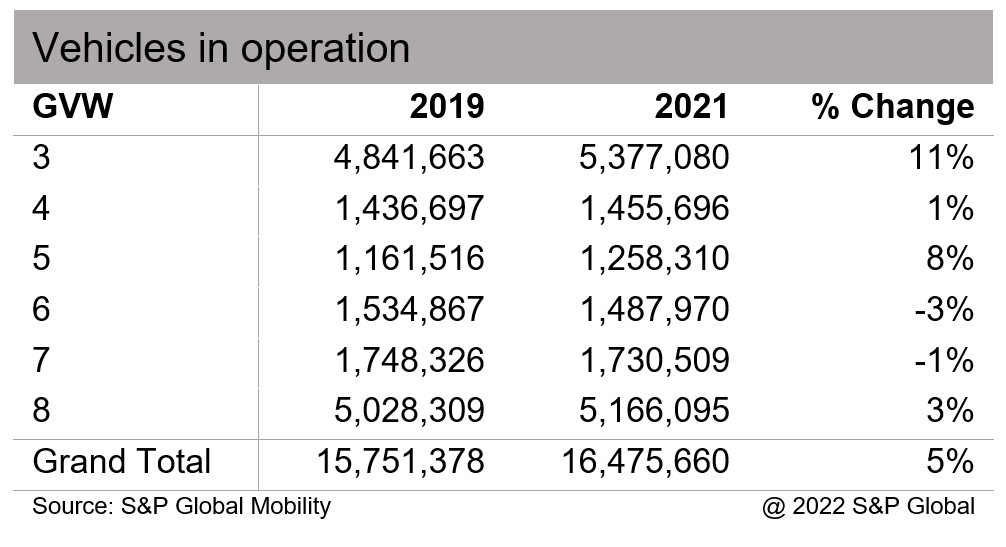

Class 5 vehicles on the road rose 8% from 2019-21 and class 8

vehicles rose 3% during that same period. Overall, we saw a 5%

increase for all vehicles on the road from 2019-21 resulting in

almost 16.5 million class 3-8 vehicles on the road at the end of

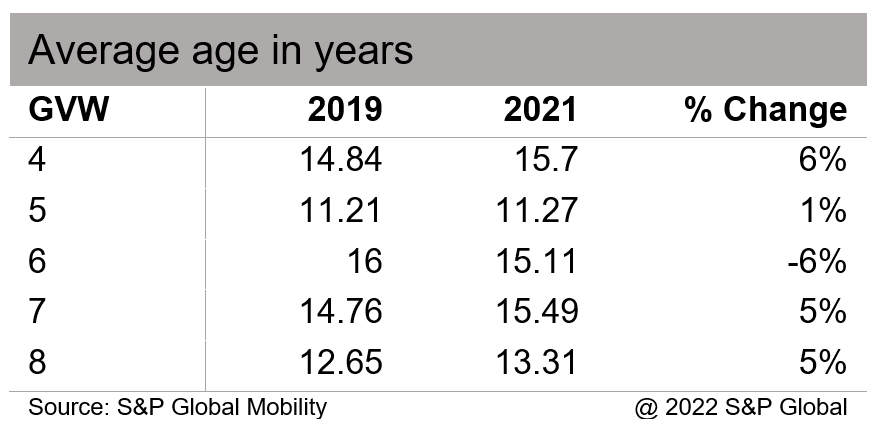

2021. Since fleets were unable to replace older vehicles, we saw an

increase in the average age by 5% for both class 7 and class 8

vehicles.

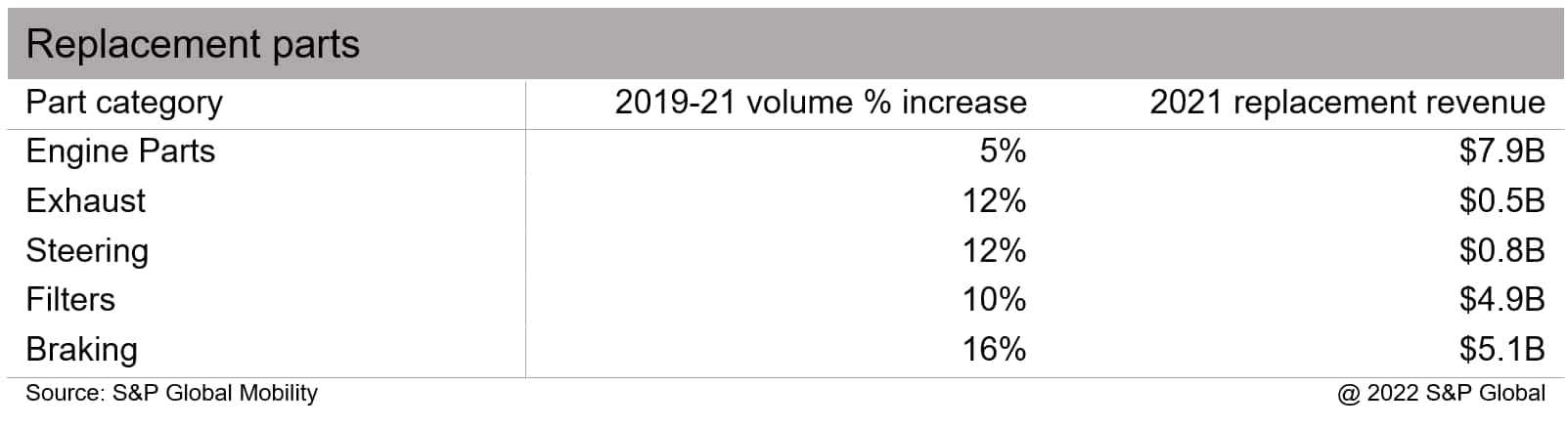

Increased VIO and the average age of commercial vehicles have

led to large increases in replacement parts revenue for the

commercial vehicle industry over the past few years. S&P Global

Mobility (formerly IHS Markit | Automotive) tracks aftermarket

parts replacement for over 95 parts common to the commercial

vehicle industry. We are seeing double digit volume increases for

exhaust, steering, filters, and braking from 2019 to 2021. Across

all 95 parts that S&P Global Mobility tracks there was $12.6

billion in replacement revenue and $5.7 billion in remanufactured

revenue for 2021.

As we continue to deal with vehicle shortages we will continue

to see older vehicles on the road which will lead to above average

demand for replacement parts.

S&P Global Mobility track’s replacement for more than 95

parts common to the commercial vehicle industry.

Download the top-5 replacements

parts for each class of commercial vehicles

Learn more about our Commercial

Vehicle Aftermarket Parts Solution.

For a deeper dive into all 95 replacement parts and attributes

(quantity, revenue, geography, vocation, GVW, fleet names) contact

us [email protected]

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

[ad_2]

Source link